|

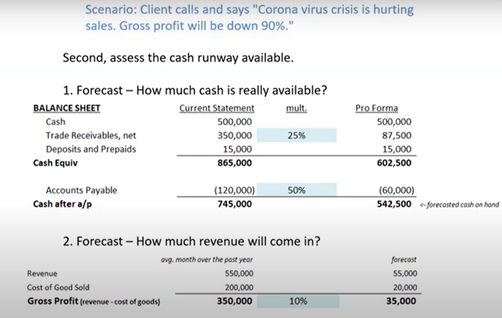

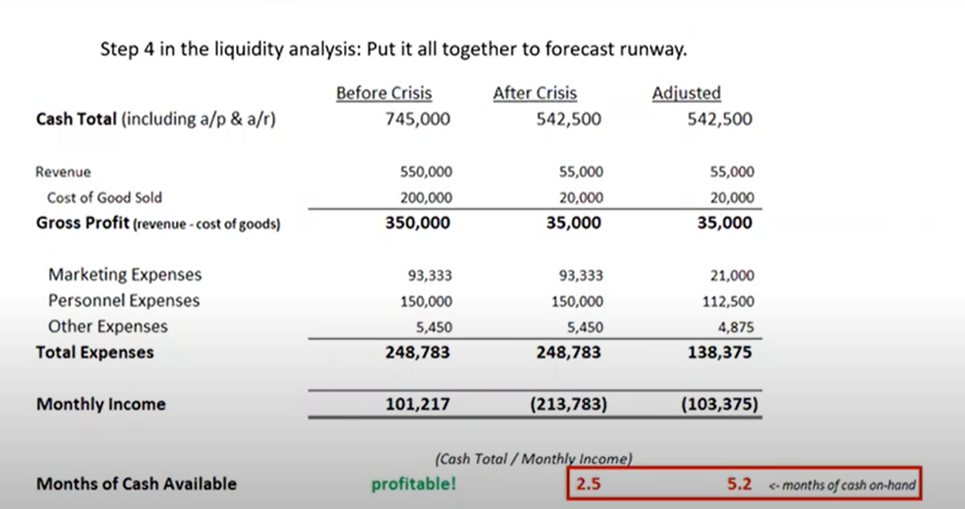

Way back in February 2020, our client, an established national business with a valued brand and solid market position, was looking forward to a great year. Sales were up, top line revenue was growing, and their balance sheet was strong. Then, COVID-19 forced a shut down and shelter in place. Our team got the call. This client’s sales, heavily driven by customers in travel & entertainment industries, were predicted to drop by 90%. Just like that. Understandably, they were panicked. The situation felt out of control. We gathered our team of accountants and advisors, many of whom have lived in the startup world, where risk and runway are always top of mind, to craft a plan. The result was a Cash Action Plan that you can apply to your business. Here’s what we did: Quality of Books, A Rapid Balance Sheet Review As you go through this process, we can’t overstate the importance of having accurate, up-to-date books. This is THE foundation of your plan. For companies that we haven’t worked with before, we always start with a balance sheet review. At a high level, if the balance sheet is correct, the profit/loss will ring true. We look at all accounts and check for indicators like when reconciliations were done and how closely account balances match bank balance. If these check out, we have enough confidence to proceed with planning based on the current numbers. If they don’t, we do not pass go – we start with clean up. Solvency Analysis, Assessing Your Cash Runway We the move to assessing solvency. In some cases, income becomes negative, and the cash runway can be measured in the number of months before the company runs out of cash. Step 1: Using the balance sheet,calculate a modified pro forma cash balance: cash plus receivables minus payables. When considering your accounts payable and receivable it is important to make necessary adjustments from the numbers on paper. Are there receivables in jeopardy of not being collected? Are there payables you may elect to defer? Adjust your numbers accordingly. Step 2: Determine how your revenue will be impacted. We like to use the average trailing 12 month revenue as a baseline. Then adjust accordingly – in this example down 90%. Your situation may vary greatly. In the case of our client, steps 1-2 looked like this: In the client example shown, the company was profitable pre-crisis. Once the crisis affected revenue, if they did not make any operating adjustments, they would have only had 2.5 months of cash available. With adjustments, we were able to get them to just over 5 months of cash in the bank which at the time was absolutely critical. Note: As you go through this process, we encourage you to think worst case scenario so you can understand what your run rate would be in the event, for instance, what is your available runway if you have NO revenue coming in? While this may be unlikely, it will give you a baseline and you can build from there. Outside of making headcount adjustments, accounts receivable and payable are where you can make the biggest adjustments, so we are going to do a deeper dive on those. Accounts Payable -- Vendor Triage

The Accounts Payable Aging Summary is a go to report for CFOs and Controllers. Here is how we use the report in the Cash Action Plan. Step 1: Review for accuracy. Is anything missing? Step 2: Go through each vendor and rate:

Step 4: Build a vendor by vendor negotiation strategy. It’s important to remember that everyone is hurting at the moment. From your counterparty’s point of view, negotiating a deferral of payment or balance reduction is often better than receiving no payment at all. Accounts Receivable – Collecting from Customers Now we are going to apply this methodology to the other side of the coin: customers. Step 1: Review for accuracy. Have invoices actually been sent? Often times in small businesses, invoicing can slip. Step 2: Go through each customer and rate:

Step 4: Build a customer by customer negotiation strategy. What do you want or need? What can you give? Where can you be soft and where do you need to draw hard lines? We suggest creativity regarding how and when you will take money. Offer payment plans or extend deadlines. Getting cash later is better than not getting it at all and with significant stress throughout the system many people are in the same boat. We believe that through honest conversations, much of this can be worked out. Non-cash Asset Liquidation and Available Credit For the last part of the Cash Action Plan, we are looking at what assets can be liquidated and what debt can be renegotiated. Step 1: Review fixed asset schedule and identify items that aren’t being used right now but have potential cash value. Does it make sense to sell these assets? Is it possible to sell into current market? Step 2: What debt instruments are in place? Is there an opportunity to renegotiate payment terms and timelines? The Plan Going through this process results in an actionable plan to help you cut costs, find cash and ultimately extend your runway so that you can outlast this crisis. Note: We recommend creating multiple versions of models of the Cash Action Plan. What do the best case, base case, and worst-case scenarios look like? In the case of our client, going through this exercise provided them with more freedom to operate and gave them the breathing room they needed to focus on strategy and solutions. The result: They’ve since identified how to introduce their products and services into new markets where there is current high demand and are in the process of making that pivot. Need help developing your Cash Action Plan? Reach out to us HERE. |

Drag & Drop elements for the Sidebar here